Our Business

Our Products and Services

FinTech Global (FGI) is a boutique investment bank* providing innovative, leading-edge financing solutions to help clients address issues of concern.

*A boutique investment bank is an investment bank that offers some of the services available from big investment banks, which pursue large-scale, broad-based activities, but on a small scale and with a specialized focus.

FGI started off with investment banking services emphasizing financial arrangements, but services now include investments and asset management to meet diverse client needs. As well, we offer local issue solutions utilizing this know-how.

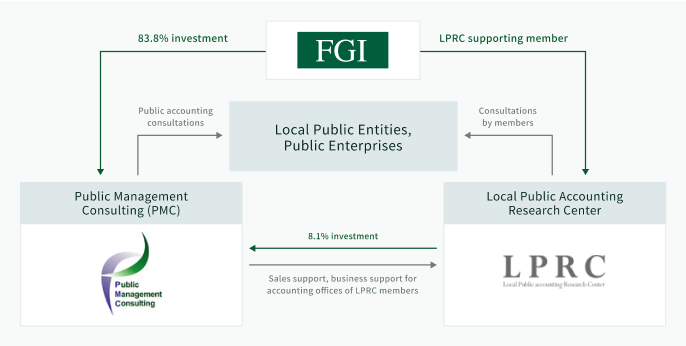

Investment Banking

The FGI Group approaches investment banking from a financing perspective that addresses various corporate and regional issues. We plan and propose financial strategies perfectly designed to solve these issues and, by assisting with fund procurement and other processes through financial arrangements and other services, we help our clients achieve their strategic goals.

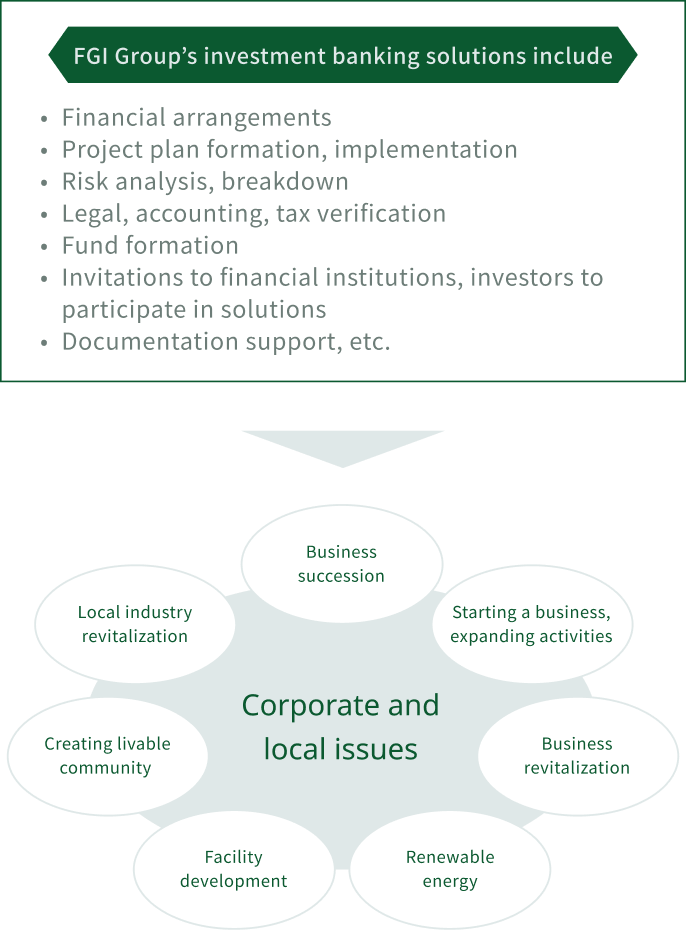

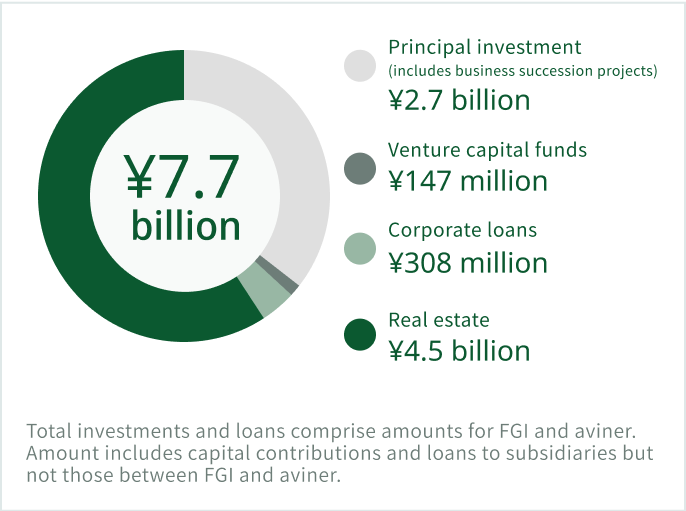

Investment

The FGI Group engages in principal investment—using own capital for investment—to raise value by discovering latent value and future prospects in projects and structures in need of capital. We also invest in companies grappling with business succession issues as well as start-ups and various real estate projects.

Total Investments and Loans (As of September 30, 2023)

Portfolio Company Profiles

Business Succession Investment

For companies grappling with business succession issues, FGI buys the company, thereby solving the issue, to create high added value.

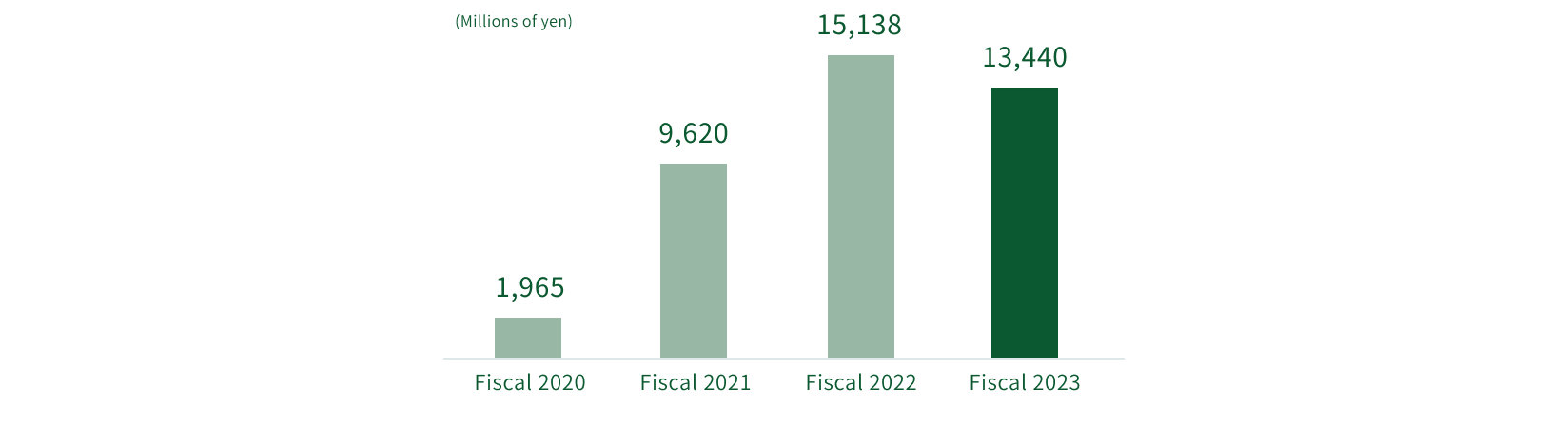

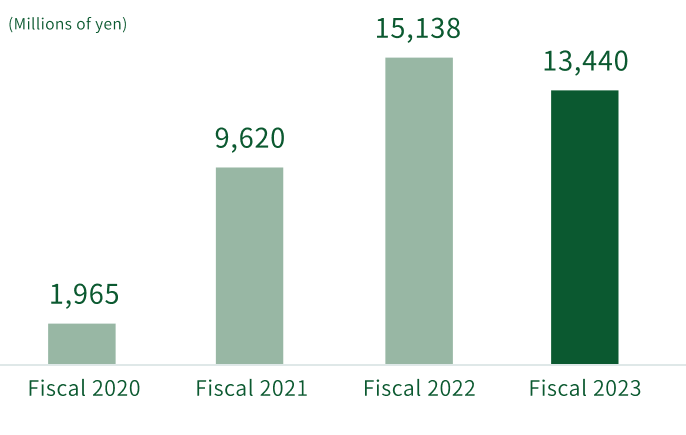

On each project, we invest through acquisition funds (nonconsolidated) formed specifically for that project through our own capital contribution as well as loans for financial institutions and other sources. The acquisition fund formation amount is trending at a consistent level above ¥10 billion on an annual basis.

On each project, we invest through acquisition funds (nonconsolidated) formed specifically for that project through our own capital contribution as well as loans for financial institutions and other sources. The acquisition fund formation amount is trending at a consistent level above ¥10 billion on an annual basis.

Acquisition Fund Formation Amount

Investment at Metsä

On the Metsä project, FGI participates through asset investment and private equity investment activities, having invested in Metsä Village assets and taking an equity stake through capital contributions into Moomin Monogatari, Ltd., which operates Moominvalley Park.

Related information

More details on Metsä

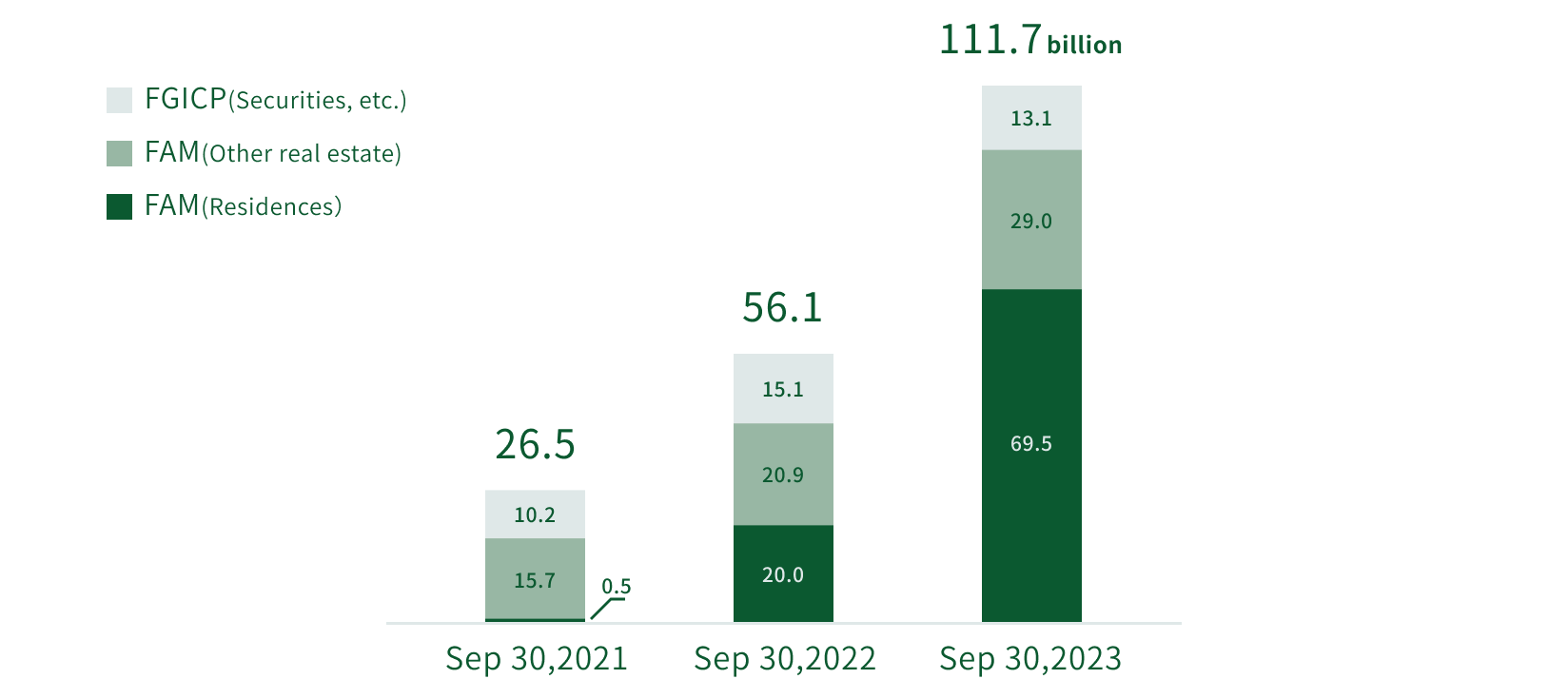

Asset Management

The FGI Group undertakes asset management on such targets as real estate and securities. In recent years, the service menu has expanded in response to an increase in requests to handle residences.

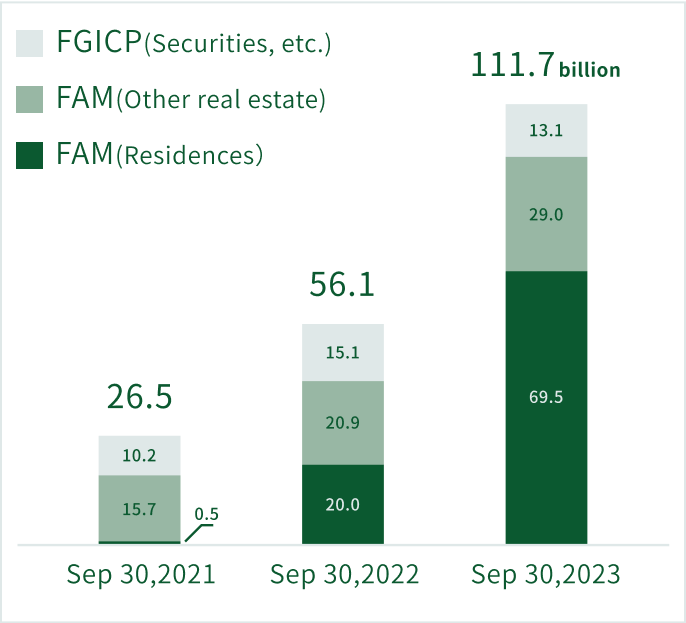

Total Assets under Management (As of September 30, 2023)

Related information

FinTech Asset Management (FAM) corporate siteFGI Capital Partners (FGICP) corporate site

Aircraft Asset Management

Looking to future business development, FGI is involved in aircraft asset management, providing aircraft technical advisory services and aircraft registration through its Netherlands-based subsidiary, SGI-Aviation Services B.V.

Related information

More details on aircraft asset management

Local Issue Solutions

We provide solutions to address issues with social impact, such as facility maintenance and upgrades, soaring energy costs and worsening regional finances, and thus contribute to sustainable regional growth.

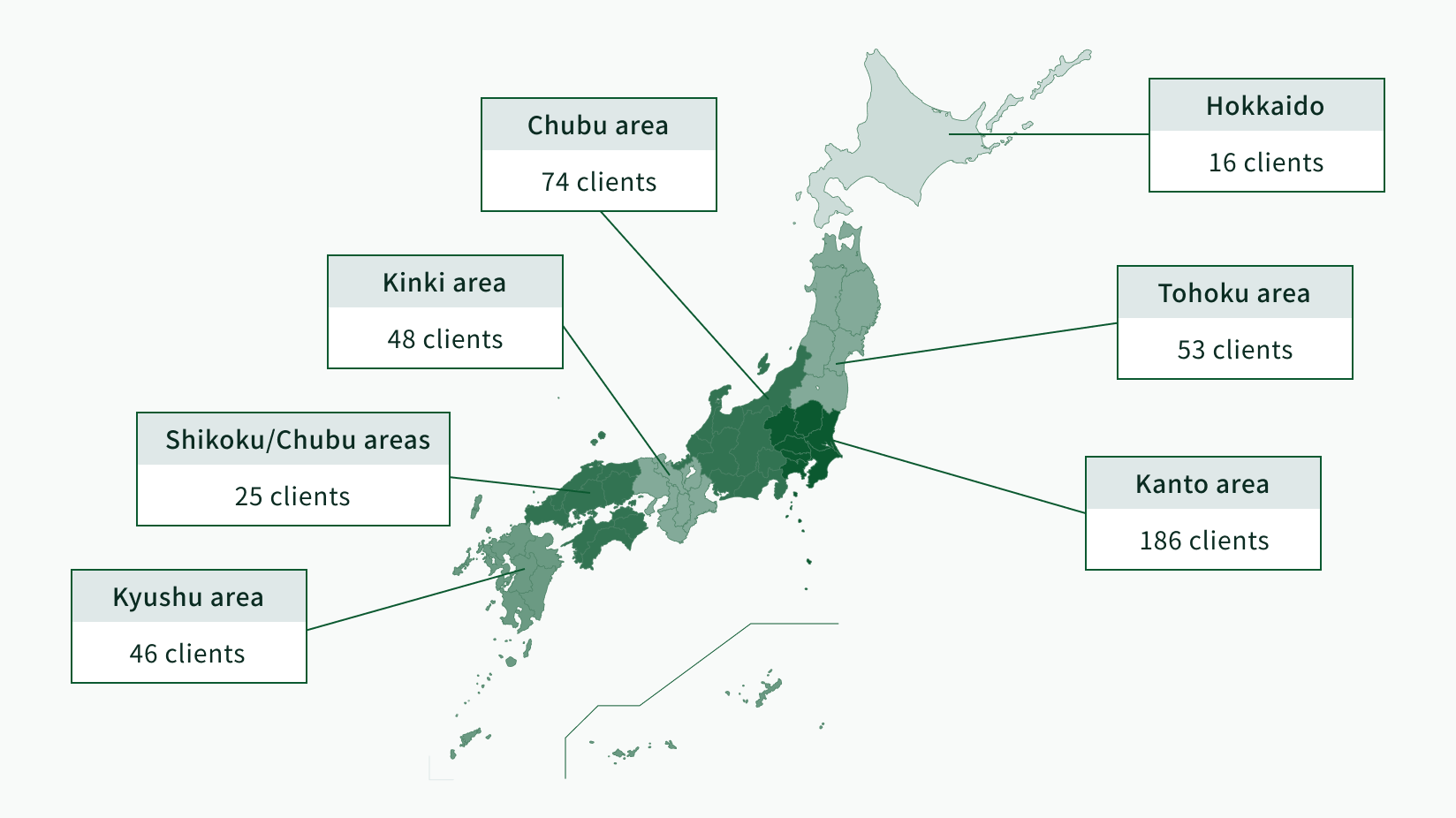

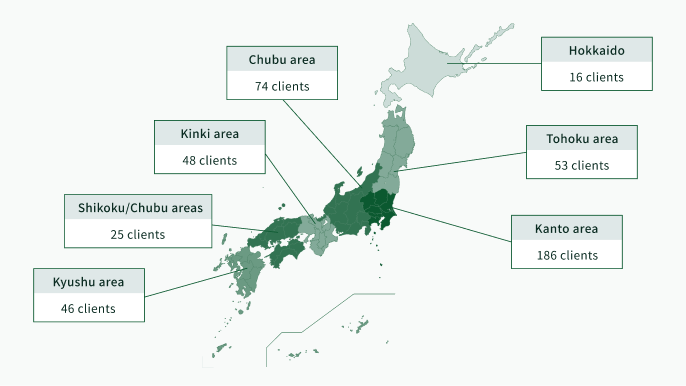

Contract Results

Public Management Consulting Corporation, an FGI subsidiary, has concluded contracts with 425 local public entities across Japan, as of December 31, 2023, for help on the preparation of financial documents and public facility management support.

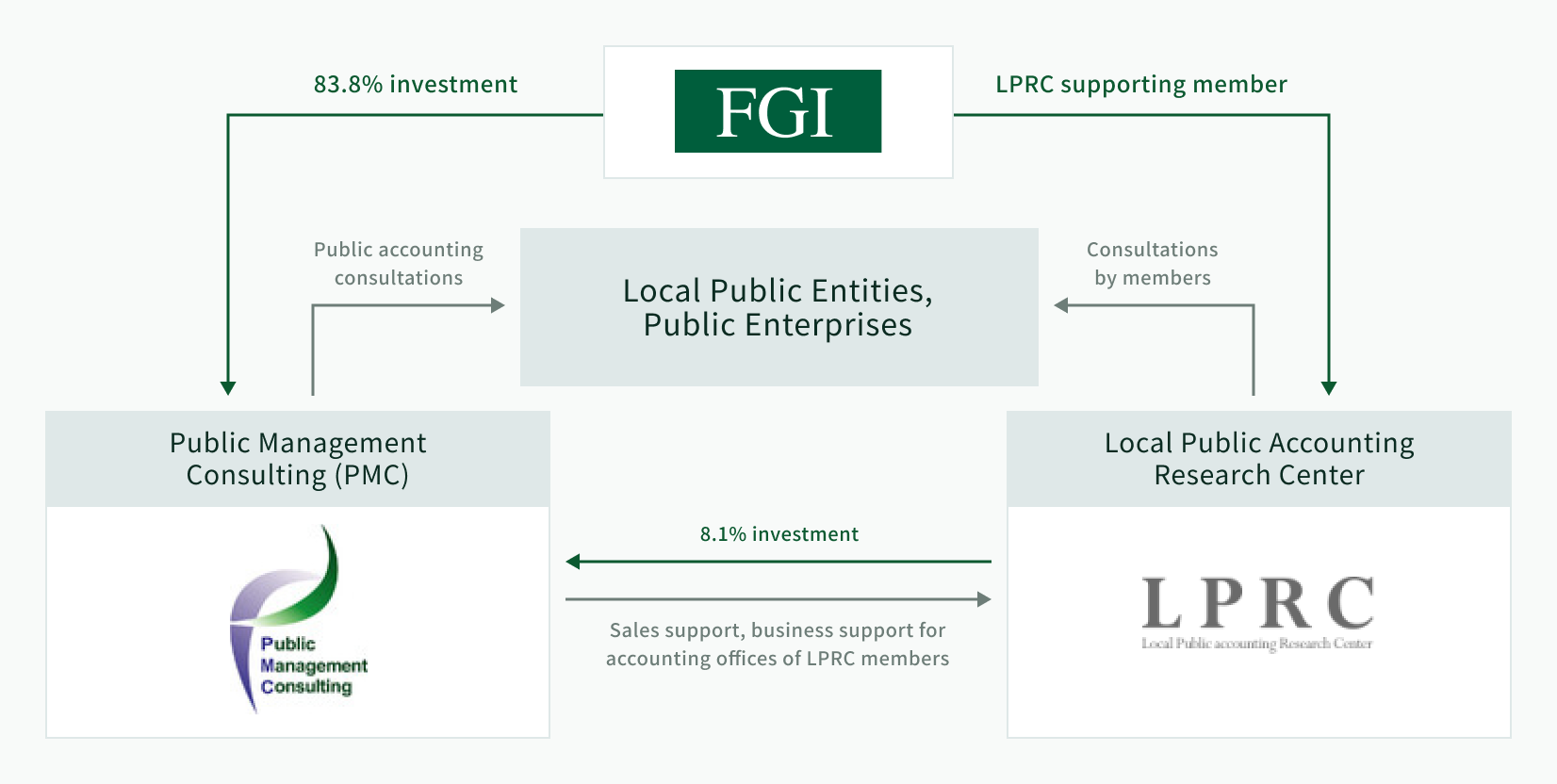

Alliance Structure

Seeking to consider and propose measures related to public accounting for local public entities and local public enterprises, PMC teamed up with Local Public accounting Research Center (LPRC) and supports widespread application and operation of local public accounting system.